First home buyers guide for a successful personal property inspection and purchase

Buying your first house is an exciting milestone. You will have made what, for most people, is the largest financial investment of your life. You’re no longer at the mercy of landlords and you’re free to turn your house into a home.

In all the excitement, it can be tempting to rush the purchase process and overlook some important steps, like properly inspecting the building. Look at it this way: You shouldn’t buy a used car without giving it a test drive and getting a qualified mechanic to give it a look over. Well, a house is a much larger investment and if you buy a lemon it can be much more expensive to fix. That’s why it’s important to complete a thorough personal inspection, building inspection and pest inspection before making an offer. Once settlement takes place, any problems with the property immediately become your responsibility. And that could mean tens of thousands of dollars in repair and maintenance work that you have to shell out on top of the purchase price. To help out all the first home buyers out there, we have some useful information about how to get the most out of your inspection opportunities before buying your first home. Personal inspection Once you’re seriously considering buying a property, your personal inspection needs to reflect this. It’s a different process to the initial open inspection. While it’s important you still like the overall feel of the house, this is the time to take a serious and focused look at the potential trouble areas and money pits around the house. Some key things to look out for are:

Building inspection While it’s important to look the property over yourself, unless you’re an expert you won’t have a good idea what you’re looking for. What may look like a great house in perfect condition could be hiding a whole bunch of structural issues. That’s why it’s vital to get a professional building inspection from a licensed building inspector. A building inspector will thoroughly check the property inside and out. They will examine all accessible structural elements, outbuildings like sheds, and external structures like fences and retaining walls. Once the inspection is complete, they will provide a detailed report that highlights any major damage or essential repairs, as well as recommending other minor repairs and even documenting any potential repair or maintenance risks. Your building inspector should always be a third-party professional – that is, someone not recommended by or affiliated with the seller or their agents. This way you can be assured of a completely independent and unbiased report. Any major issues with the property should be presented to the seller before purchase. You can then negotiate to have these issues fixed before purchase or adjust the purchase price accordingly. Don’t take the risk If you think you’ve found your dream home, you can’t afford the risk of it turning into a nightmare. Hiring the professionals to carry out the building inspections and pest inspections can help you to make the most informed purchase and avoid the massive repair and maintenance costs that come with buying a shoddy property. Call us now on 021 143 2995 - Savvy Houz Inspections , www.savvyhouz.co.nz Pre purchase home inspection company based in Christchurch, Savvy Houz Inspections

3 Comments

Buyers beware over $100k in subfloor and foundation repairs.Building reports are a must to prevent costly unexpected repairs.

Major issues identified in the subfloor after the property had been purchased.

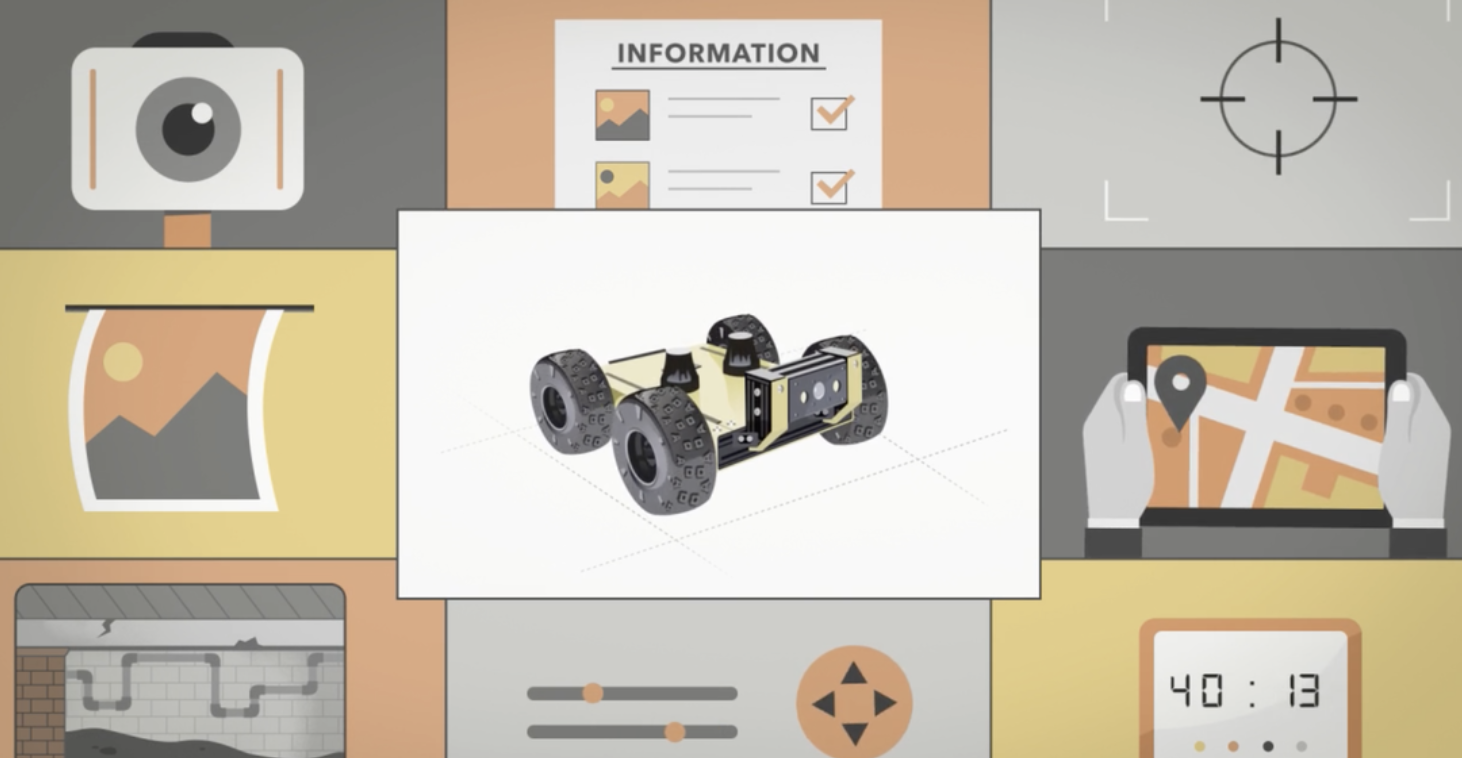

A homeowner who bought a house only to discover more than $100,000 worth of damage has warned property-hunters to pay closer attention to their pre-purchase inspection reports. A building and pest report, provided by the selling agent, did not highlight any significant issues, but noted that the building inspector had been unable to access parts of the property. A second report found significant termite damage, structural damage and borer damage. “The report basically said most things were mostly fine, with the caveat that they hadn’t looked underneath the house,” he said. “Not being an experienced property buyer, I assumed they didn’t need to look under the house because there was no reason.” The original report, which covered the “roof void, internal area, external area and extension”, warned that areas not inspected included “the entire subfloor” and “various areas of the roof void”. “A subfloor void appears to be present however, we were unable to located (sic) an entry point and therefore no inspection of the subfloor area was carried out,” the report said. “It is possible that an entry point may exist below floor coverings (if fitted). It is possible that building defects may be present below inaccessible areas however, no comment is made or opinion offered on any area where full access is not available. “We strongly recommend that access be gained to all inaccessible areas. Access should be gained to enable a further inspection to be carried out prior to purchase.” The second report was obtained by another potential buyer, who opted not to bid based on the damage uncovered. That report inspected the “building interior, building exterior, roof exterior, roof space, subfloor space, outbuildings and the site”. “Various areas have significant termite damage,” the report said. “Previous attempts had been made to support the middle bearer under the second bedroom with brackets that have been bolted into the brick foundation walls. Despite this, the bedroom floor is not level. “(The) timber bearer below the front area of the living/lounge room has been totally eaten by termites. The centre of the lounge room is no longer supported in some areas by this bearer. It needs replacing urgently. “To help protect against financial loss, it is essential that the building owner immediately control or rectify any evidence of destructive timber pest activity or damage identified in this report.” Under changes introduced in August 2016, real estate agents are required to inform potential buyers if a pre-purchase building and pest inspection report or strata and community scheme report has already been carried out. Buyers may then opt to access an already available report, usually at a reduced cost, instead of commissioning their own report — giving building inspectors an extra incentive to get in first. In an email to one real estate agent, the inspector who carried out the original report on the St Peters home urged the agent to put him on the list early, pointing out that “per the new legislation”, a report already carried out by “any other company, and there are some pedantic ones out there” must be listed “to your vendor’s detriment”. He added that his inspectors “don’t put in any prices on repairs” and were “not pedantic or overly critical of the property”, as that was “such a headache for agents with some inspectors”. The St Peters buyer admitted he should have been more careful. “It’s at least partly my fault, I’m happy to admit that, but it’s crap that these types of inspection reports are allowed,” he said. He added that he didn’t bother seeking legal advice. “Part of the problem with these reports is every second sentence is a caveat,” he said. “They limit liability as much as possible. I saw [legal action] as potentially a bit of a money pit that could go nowhere.” The owner of the company which carried out the original inspection strongly defended his report. “There was no access to the subfloor ... and another inspection was recommended after access has been made available,” he said in an email. “This is the first we have heard of it. If the purchaser actually read the report and followed our recommendations ... before purchase of the property as recommended ... then any termite or borer damage in the subfloor area would have come to light, and any legal advice that he would have had then (sic) made him aware of this fact. “That’s why we have heard nothing about it and will be watching closely if any we take any action (sic) if defamed in any way as we stand fully by our report.” Rhys Rogers, chief executive of sharing economy site Before You Bid, a platform where buyers can share costs and rate inspectors, said consumers should be very careful doing their research. “There are two things which can help consumers work out whether they’re getting a report that’s worthwhile,” he said. “One is to check on Google to see the inspector’s rating. Two is to check if the inspector got under the house and into the roof, because that’s where most defects are, that’s where the hard work is crawling into these spaces. “(If they don’t), it’s a pretty obvious sign that the inspector might just be ticking the box — there should be a good reason. Sometimes they’ve got quite a few disclaimers in these reports, they can argue that on the day there was no access to the subfloor because there was a piece of furniture in the way.” If the report has gross omissions the buyer can make an insurance claim against the inspector, but Mr Rogers said underinsurance was also a big issue. “There are estimates that 70 per cent of the industry aren’t properly insured,” he said. A spokeswoman for Fair Trading/Consumer Law, any pre-purchase building and pest inspection reports must comply with “consumer guarantees in relation to the provision of services”. “Services must be provided with acceptable care and skill or technical knowledge and taking all necessary steps to avoid loss and damage, fit for the purpose or give the results agreed to, (and) delivered within a reasonable time,” she said. “Fair Trading strongly recommends that vendors only use consultants that have adequate insurance cover, particularly for professional indemnity.” frank.chung@news.com.au Book a subfloor robot inspection today! 021 143 2995 - Call Savvy Houz – Inspect it to protect it! What to look out for when buying older properties built before 1914?An unbiased building inspection report will uncover any significant building defects that will save you from major financial losses

This blog post highlights some of the most important building issues and risks. We recommend you research further, before making an offer?

built before 1914: Look out for:

Timber built villas were the most popular design style in this period. The bungalow style started to appear in New Zealand from 1910. A home built before 1914 will have plenty of history and character features, but it can also come with issues if it hasn’t been properly maintained over the years. Timber: Look out for:

Timber — including treated plywood and engineered wood products. A wooden exterior or cladding needs ongoing maintenance, and there may be problems if it hasn’t been properly and regularly maintained. Extensions and renovations: Check that any extensions or renovations have building consent. You can check by comparing the current layout with the floor plan on the property file held by the council. Any differences between the two should have the proper building consents. If the owner or a previous owner has added a deck, garage or sleepout, check that the consents are on file. It may be possible to get building consent on an extension or renovation after you have purchased the property, but it is not certain and it could be expensive if extra work is needed to meet required standards. Check the foundations of the extension. If the foundations are different from the rest of the house, they may move in different ways in an earthquake. Also check that the foundations and the connections between them are in good condition. Work that should be consented: Building work that may require consent includes:

Roof material Look out for:

Iron and steel — including corrugated and long-run. These roofs last between 40 and 70 years, depending on what they’re made of, the environment and regular maintenance. An iron or steel roof will need to be repainted or re-chipped every 10 years to ensure the roof remains watertight. Hillside Slopes:

Earthquake Damage EQC and Liquefaction: These features can make some buildings more susceptible to liquefaction-induced damage.

Flooding Zones: Look out for:

Types of ownership: Freehold Is also known as fee simple and is the most simple and common ownership type in New Zealand. Freehold If you have a freehold property, you own the land and (generally) anything built on the land unless there are any registered or unregistered interests. Examples of interests that might restrict the use of the property include:

Ask your lawyer or conveyancer to review the record of title (also known as the certificate of title), which contains the property’s legal description, details of its ownership and the rights and/or restrictions registered against it. A cross-lease property, you own two interests in the property — a share of the freehold title in common with the other cross-leaseholders and a leasehold interest in the particular area and building that you occupy. A cross-lease title may include a plan showing the footprint of the building you are entitled to occupy (sometimes called the flats plan). Check the plan to identify:

This means that, depending on the terms of the cross-lease, you may need to obtain the other owners’ consent before painting the exterior or making other non-structural changes to the building you occupy or before making structural changes, for example, building a deck or putting up a fence. There may be restrictions on what you can do with the property under the terms of the lease registered on your title. Ask your lawyer or conveyancer to review the record of title (also known as the certificate of title), which contains the property’s legal description, details of its ownership and the rights and/or restrictions registered against it. Have questions about a property?

Call Savvy Houz Inspections today 021 143 2995 |

BLOG

March 2024

Categories |

LocationLocated on Grahams Road, we are right in the centre of Christchurch, making it a lot easier on the whole for people to reach out to us for help at any time during the day. |

|

RSS Feed

RSS Feed